Project Overview

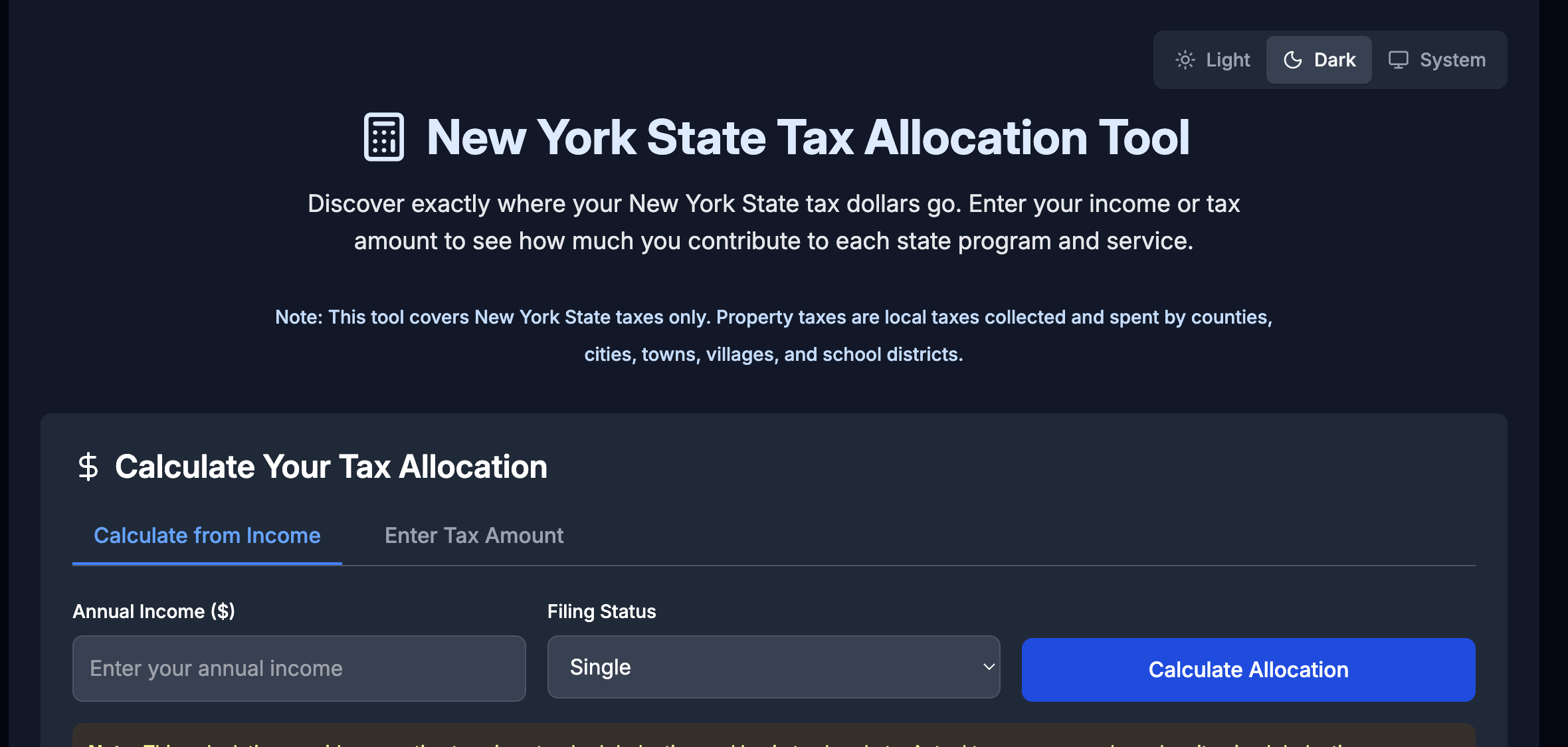

The New York State Tax Allocation Tool transforms complex government budget data into an accessible, interactive experience that shows taxpayers exactly where their money goes. This civic technology project addresses the fundamental disconnect between tax payments and government spending by providing detailed, personalized breakdowns based on official NY State budget documents.

The application serves multiple tax types including personal income tax, corporate tax, and sales tax, supporting all five filing statuses with accurate 2025 tax brackets. Users can either calculate their tax liability from income information or enter their actual tax amount directly to see real-time allocation breakdowns across 13 major budget categories.

Key Features

Comprehensive Tax Calculator

-

All five filing statuses (Single, Married Filing Jointly/Separately, Head of Household, Qualifying Widow(er))

-

Accurate 2025 New York State tax brackets with standard deductions

-

Flexible input methods allowing income calculation or direct tax amount entry

-

Real-time calculations with instant allocation updates

Detailed Budget Breakdowns

-

13 major spending categories from Education/School Aid (29%) to Arts & Cultural Programs (1%)

-

Specific program descriptions for each allocation (K-12 schools, Medicaid, SUNY/CUNY, etc.)

-

Tax expenditure analysis showing user contributions to credits and exemptions for other New Yorkers

-

Corporate and sales tax allocation models with category-specific breakdowns

Transparency & Data Integrity

-

Based on official FY 2026 NY State budget documents and tax expenditure reports

-

Data sourced from OpenBudget.NY.Gov and NY State Department of Taxation and Finance

-

Anonymous usage analytics stored in Cloudflare D1 database for insights without compromising privacy

-

Clear methodology explanations and data source citations

Development Process

The project began with extensive research into New York State’s budget structure and tax allocation methodologies. I analyzed the FY 2026 Enacted Budget, tax expenditure reports, and official government databases to ensure accuracy in calculations and allocations.

The technical architecture leverages Cloudflare Workers for global deployment with edge computing capabilities, ensuring fast response times regardless of user location. The D1 database integration provides robust analytics while maintaining user privacy through anonymous session tracking.

User experience design focused on progressive disclosure, starting with simple input forms and gradually revealing detailed breakdowns. The responsive design ensures accessibility across all devices with high contrast text and screen reader compatibility.

Technical Highlights

Modern React Architecture

-

Built with React Router 7 for client-side routing and navigation

-

TypeScript implementation for type safety and developer experience

-

Tailwind CSS for responsive, utility-first styling

-

ESLint and Prettier integration for consistent code quality

Cloudflare Workers Deployment

-

Serverless architecture with global edge distribution

-

D1 database integration for analytics with SQL schema design

-

KV namespace support for caching optimization

-

Custom domain deployment with SSL/TLS encryption

Data Processing & Analytics

-

Complex tax calculation algorithms supporting multiple filing statuses

-

Budget allocation algorithms based on official state spending percentages

-

Anonymous session tracking with comprehensive usage analytics

-

JSON-based allocation storage for flexible data retrieval

Implementation

// Tax calculation with filing status support

const calculateNYTax = (income, filingStatus) => {

const brackets = TAX_BRACKETS[filingStatus];

const standardDeduction = STANDARD_DEDUCTIONS[filingStatus];

const taxableIncome = Math.max(0, income - standardDeduction);

let tax = 0;

let remainingIncome = taxableIncome;

for (const bracket of brackets) {

const taxableAtBracket = Math.min(remainingIncome, bracket.max - bracket.min); tax += taxableAtBracket * bracket.rate;

remainingIncome -= taxableAtBracket;

if (remainingIncome <= 0) break;

}

return tax; };

const calculateAllocations = (taxAmount, taxType = 'income') => {

const allocations = BUDGET_CATEGORIES[taxType].map(category => ({

name: category.name,

amount: taxAmount * category.percentage,

percentage: category.percentage,

description: category.description

}));

return allocations.sort((a, b) => b.amount - a.amount);

};Results

The tool has successfully democratized access to government budget information, making complex fiscal data comprehensible to everyday taxpayers. The interactive format encourages civic engagement by showing users their direct stake in government operations.

Impact Metrics:

-

Comprehensive coverage of all NY State tax types and filing statuses

-

13 detailed budget categories with specific program breakdowns

-

Real-time calculations providing immediate transparency

-

Privacy-first analytics enabling usage insights without data collection

Technical Achievements:

-

Global deployment with sub-second response times via Cloudflare Workers

-

Responsive design supporting all device types and accessibility standards

-

Robust database architecture handling complex tax calculations and allocations

-

Open-source approach encouraging community contributions and transparency

The project represents a successful intersection of civic technology and modern web development, demonstrating how technical expertise can enhance democratic participation through improved government transparency.